Alfred Nobel's wealth seems paltry. It's not.

I absolutely love Veritasium. One fine Saturday, I watched their piece on Alfred Nobel - how he (sort of) salvaged his legacy despite inventing the explosives and improved bullets that killed millions. He had 90+ factories across the world producing dynamite, ballistite, and other products used for tunnels, bridges, and bombs.

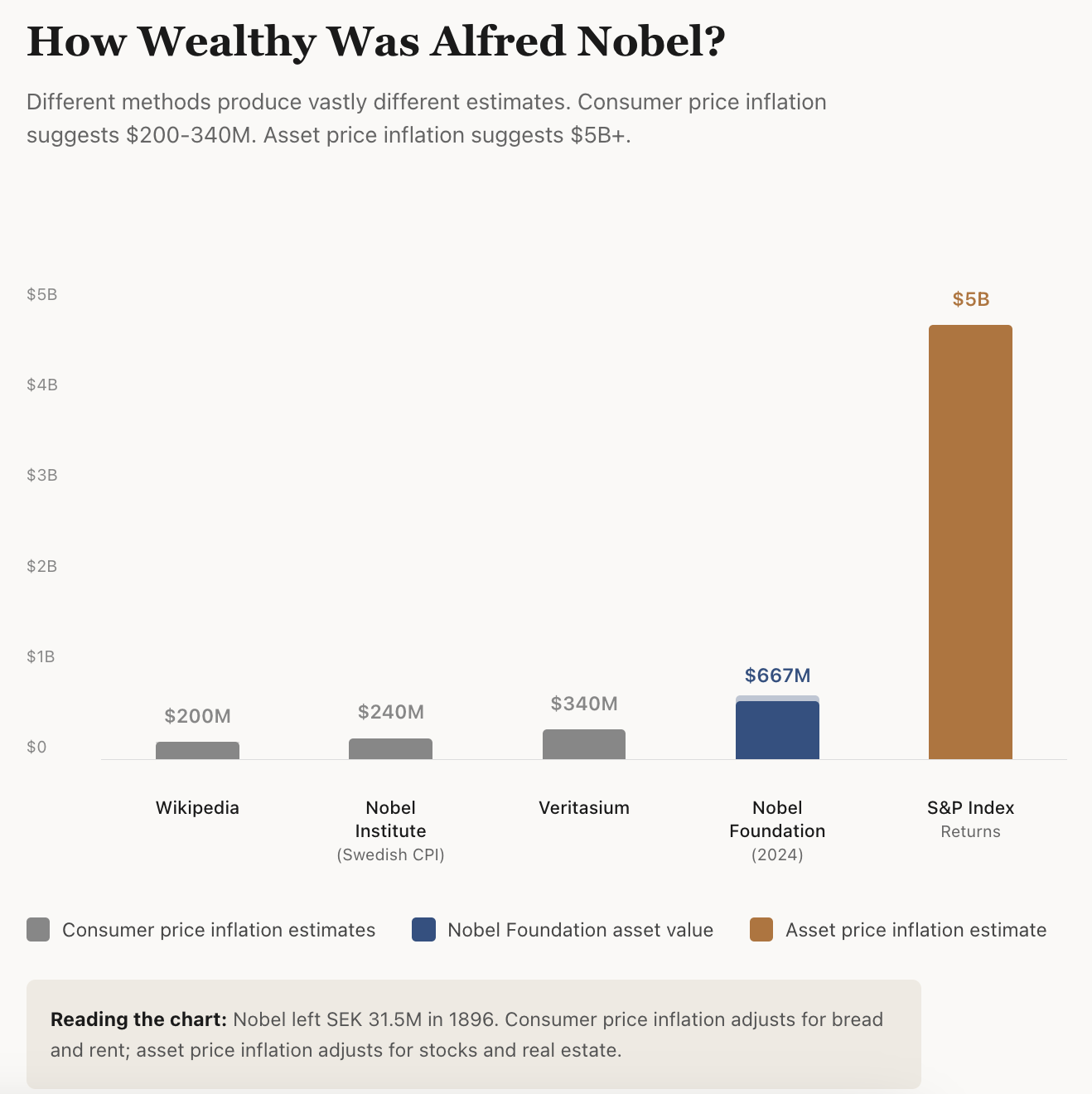

The video ended with a striking claim: Nobel’s wealth, in today’s value, was around $340M.

That’s it? $340 million? That’s a paltry sum compared to the wealth of today’s tech trillionaires. Startups today have revenues exceeding $340M. Nobel invented technology that defined his era. It wasn’t just dynamite, it was also the smokeless gunpowder that shaped modern warfare, and the bullets that stood the test of time. He had factories in 90 countries. His company was the Nvidia or Anthropic of its time. It puzzled me. So I investigated.

The Nobel Institute quotes SEK 2.2 billion, roughly $240M. Sweden’s official inflation data gives a similar figure. Wikipedia suggests $186M was 94% of his estate, implying around $200M total. An NIH paper cites $300M.

The estimates cluster between $200-340M. The variation might be because of different inflation indices (Swedish CPI vs US CPI), different base years, different currency conversion timing. But even Veritasium’s high estimate of $340M feels impossibly low for the inventor who built the pioneering tech of his time.

And then it clicked. We all make the same mistake while estimating wealth. Perhaps we use the wrong yardstick. As sensible people like Ruchir Sharma and Edward Chancellor have been saying, asset prices inflation is out of whack. It has far outstripped consumer price inflation, thanks to the era of easy money. In the book, “What went wrong with Capitalism”, Sharma explains that globally, central banks (such as the Fed, Bank of England and European Central Bank) have been hypper focused on consumer price inflation while ignoring asset price inflation. They control money supply by setting interest rates.

Low interest rates have allowed firms to use easy debt (instead of their own cash flows) to buy back shares, engineer a higher return on equity, and inflate share prices. In times of easy money, investors (pension funds or retail investors) flock to risky assets such as stocks instead of long dated government bonds.

I can go on and on about this and his could fill (yet another) book. But let’s return to Alfred Nobel and Veritasium. Let’s estimate how wealthy Alfred Nobel actually was. Caveat - a true estimate is not possible because the world of today is different from the world of his time. In fact, today’s physical world of tunnels, bridges and explosives has been actively shaped by his work.

Let’s assume he transferred all his wealth to the US right before his death. As per the exchange rate at the time, it would have yielded him $8.3M. Let’s assume he put all of that in a fund that tracks The US market (Shiller composite) index. In 2025, it would have yielded him close to $5Bn, and not $340M as the video claimed. And if we apply the tech premium (tech firms trade at 40X P/E vs S&P trades at 20x P/E ^), his wealth would have been $10Bn.

The Nobel Foundation itself demonstrates this disparity. They started with SEK 31.5 million in 1900. After 125 years of paying out prizes (billions in total), their assets at the end of 2024 stood at SEK 6.8 billion ($600-734M depending on exchange rates).

So was Nobel a billionaire? By consumer price inflation, no. By asset price inflation (the measure that actually matters for wealth), almost certainly yes.

When we estimate historical wealth, we reach for consumer price inflation by default. But wealth is usually concentrated in assets such as bonds, stocks and real estate. Until we recognise that distinction, we’ll keep underestimating fortunes of the past and ignoring the glaring problem of easy money in the 21st century.